Overview: This article challenges the misconception that millennials and younger generations avoid traditional financial advice, highlighting the transformative impact of strategic financial planning for young professionals. It presents a real-life case study of a young couple’s journey with the Lanteri Partners Group.

In an era where financial autonomy is highly prized, the narrative that younger generations, particularly millennials, are avoiding traditional financial advice in favour of do-it-yourself strategies has gained traction. However, this view overlooks a critical aspect of financial planning: its capacity to transform lives over the long term, something that Lanteri Partners Group has been witnessing as it diversifies its client base to include not just well-established or retired individuals but also ambitious young professionals.

The disconnect between perceived cost and the intrinsic value of financial advisory services has been a significant barrier. Many young professionals struggle to see beyond the immediate expense, failing to recognize the compound benefits of early, strategic financial planning. Superannuation, a cornerstone of financial security in later life, often goes underappreciated until it’s too late. This lack of foresight can result in missed opportunities to leverage one’s financial position for both current satisfaction and future prosperity.

Research from Findex highlights the substantial benefits of professional financial advice, noting a potential $664,000 difference in net assets by retirement for those who seek advice early. Despite recognizing the value of such guidance, a significant gap exists between appreciation and action, with cost cited as a major barrier. This perception challenges the financial industry to evolve, offering more accessible and relevant services to a generation standing on the precipice of a significant wealth transfer.

A Real-Life Transformation Journey

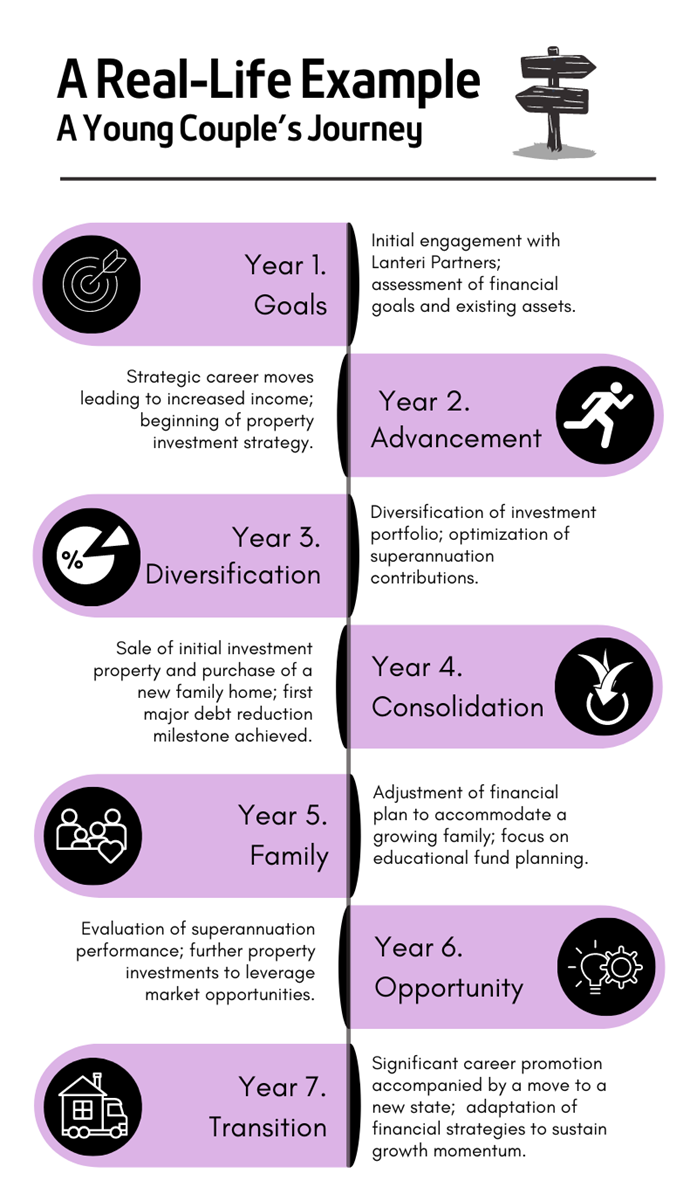

Consider the real-life journey of a young couple that engaged Financial Planning services at Lanteri Partners in their mid-30s. Initially sceptical about the value of financial advice, their perspective shifts as they engage in a tailored financial strategy.

Below is a real-life timeline based on this particular couple’s journey:

This financial journey encompasses not just investment and superannuation optimization but also navigates through employment changes, property investments, and planning for their family’s future. Their story underscores the transformative power of personalized financial advice, illustrating how it can align with evolving life stages and financial goals, leading to significant growth and security.

The role of superannuation in this transformation cannot be overstated. As a critical component of long-term financial well-being, engaging with it strategically from an early stage can dramatically alter one’s financial landscape upon retirement. Yet, its importance is often overshadowed by more immediate financial concerns, underscoring the need for comprehensive financial education and advisory services that resonate with younger clients.

Demystifying Financial Advice

Addressing the cost-value paradox is crucial. By demonstrating the tangible benefits and long-term gains of professional financial planning, advisory firms can bridge the gap between perception and reality. The key lies in demystifying financial advice, making it accessible and relevant to a generation that stands to inherit significant wealth but may be ill-prepared to manage it effectively.

The narrative that millennials and younger generations are disengaged from traditional financial planning needs revisiting. Through the lens of evolving client demographics and the compelling journey of individuals who have reaped the benefits of early and strategic financial engagement, it’s clear that the value of financial advice transcends generational divides. For those willing to look beyond the immediate costs, the rewards of professional financial planning offer not just financial growth but a roadmap to achieving life’s milestones with confidence and clarity.

Interested in transforming your financial future? Lanteri Partners Financial Planning services are tailored to guide young professionals and seasoned investors alike.

Reach out to discover how our expertise can align with your financial goals. Contact us today.

Tarik Karama