When it comes to investing, we all have different goals in mind. Each of our investors has a unique approach according to their own circumstances and financial goals.

From aggressive short-term tactics to a more relaxed and conservative long-term approach, there are a multitude of different ways to approach investing.

We have developed three distinct managed Investment Portfolios to suit our different investors.

Diversified

Multi Asset

40% Income

60% GROWTH

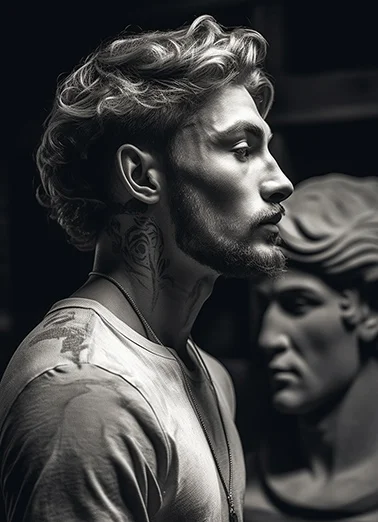

Our Michelangelo Portfolio; also known as our Active Income option, is a lower-risk investment portfolio suitable for investors with a lower tolerance for risk and a preference of income generation over capital appreciation. Michelangelo was a visionary artist and sculptor. He created masterpieces that epitomised the spirit of the Renaissance. Michelangelo’s creations demanded meticulous precision to avoid jeopardising the whole. The Michelangelo Portfolio mirrors this meticulousness, aiming to reduce risk and safeguard capital despite shifts in the market.

Lower risk investors typically want to focus on preserving their existing capital. Our Michelangelo Portfolio aligns perfectly with a prudent investor’s discerning approach, boasting a well-curated mix of stable fixed-income assets and dividend-yielding stocks.

Michelangelo’s cautious and intentional nature acted like a safety net for his creativity, allowing him to create enduring works that transcended time. Similarly, a low-risk investor seeks to preserve their wealth while nurturing it for sustained long-term growth, ensuring that each calculated financial decision contributes to the masterpiece that is their portfolio. Due to the nature of this portfolio type, there may be a more limited potential for high returns, but this option offers investors greater stability and peace of mind.

Suitable for: Investors who prefer predictable recuring income, or simply investors who want to opt for safer and slow investing.

If any of these traits sound like you, the Michelangelo portfolio may be the perfect investment option for your needs.

Managing these different investment portfolios requires ongoing maintenance to continue to ensure optimum performance. Here’s how we maximise returns and minimise risk for our investors.

Maintaining diversified portfolios is essential for risk management. We spread our investments across various industries, sectors, and geographic regions, reducing exposure to individual risks and creating a robust investment mix.

Diversified

Multi Asset

30% Income

70% GROWTH

Our Da Vinci Portfolio is a moderate growth investment option, seeking to get an equal split of its returns from income and capital appreciation. Channelling the brilliance of Leonardo da Vinci, the Da Vinci Portfolio weaves stability and growth into a financial balancing act.

This portfolio is best for investors who will benefit from a balanced mix of risk and return. Just as Da Vinci’s designs constantly evolved with his own growth, this portfolio’s strategic balance endures market shifts. Whether it’s seizing growth opportunities or safeguarding your capital, this option is the steadfast guardian of your hard-earned capital.

This portfolio tactically blends diversification and asset allocation to achieve an equilibrium of investment returns. As such, it might include a combination of stocks, bonds, property and or other asset classes. These investments will aim to provide moderate growth while still providing some downside protection.

Suitable for:

Investors of all ages who want a more stable investment option while still seeing moderate returns.

If any of these traits sound like you, the Da Vinci portfolio may be the ideal investment option for your needs.

Managing these different investment portfolios requires ongoing maintenance to continue to ensure optimum performance. Here’s how we maximise returns and minimise risk for our investors.

Maintaining diversified portfolios is essential for risk management. We spread our investments across various industries, sectors, and geographic regions, reducing exposure to individual risks and creating a robust investment mix.

Diversified

Multi Asset

20% Income

80% GROWTH

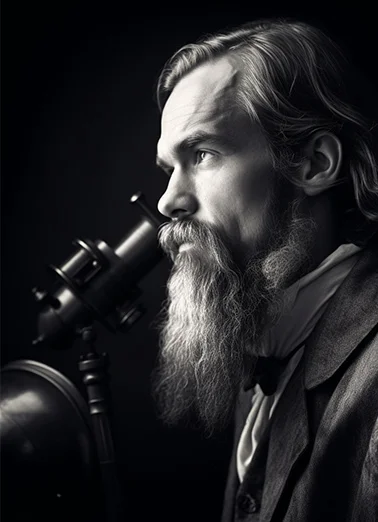

Are you willing to take a few risks in your investment journey? Taking its cue from Galileo’s trailblazing legacy as the figure who fearlessly challenged the norms of his time, the Galileo Portfolio is about breaking away from the crowd and taking calculated risks with the potential for strong returns. Our Galileo Portfolio is a more aggressive portfolio option, specifically tailored for investors looking for substantial long-term growth.

While still maintaining a diverse mix of asset classes, our Galileo Portfolio is focused on maximising returns over the long term. The Galileo Portfolio isn’t scared of a little chaos, embracing ups and downs for potential jackpots down the road.

Just like Galileo was supported by the Medici family, this portfolio mixes old-school investment smarts with modern know-how in order to carve out an adventurous route for investors. However, as with any big adventure, there is risk involved. This portfolio has a chance of increased volatility and the possibility of larger fluctuations in value over time.

Suitable for: This investment portfolio is better suited for investors that are prepared to accept a higher degree of risk, or with a longer investment horizon to withstand market volatility.

Managing these different investment portfolios requires ongoing maintenance to continue to ensure optimum performance. Here’s how we maximise returns and minimise risk for our investors.

Maintaining diversified portfolios is essential for risk management. We spread our investments across various industries, sectors, and geographic regions, reducing exposure to individual risks and creating a robust investment mix.

The Da Vinci Portfolio is designed for investors who want a balanced mix of risk and return, offering moderate growth and downside protection.

The Galileo Portfolio, our high growth portfolio option, is tailored for investors willing to embrace higher risk for potential substantial long-term growth, best suited for those with a long investment horizon.

The Michelangelo portfolio is suitable for investors with a lower risk tolerance, seeking capital preservation and stable returns. These investors typically have a preference for income generation over capital appreciation.

General Advice Warning: The information and advice contained in this brochure and in the PDS and Investment Menu is general information and advice only and does not take into account your individual objectives, financial situation, needs or circumstances. You should therefore consider whether investing in our digital investing service is appropriate for you, having regard to your objectives, financial situation, needs and circumstances. You should read the PDS, which you can obtain from www.openwealth.net.au before making a decision.

If you require assistance in determining whether an investment in the service is right for you, you will need to speak to us about obtaining personal advice, which falls under our Lanteri Partners Financial Management service offering because it will be tailored specifically for you. Our digital investing service is provided within OpenWealth, and via the OpenInvest Portfolio Service, ARSN 628 156 052, an IDPS-like managed investment scheme registered with ASIC under the Corporations Act and issued by Responsible Entity and Administrator, OpenInvest Limited (ACN 614 587 183, AFSL 504 155).”

Medici Invest is distributed by Lanteri Partners Financial Management Pty Ltd (ACN 060 748 594, AFSL 239 127) and administered by OpenInvest Limited (ACN 614 587 183) via the OpenInvest Portfolio Service (ARSN 628 156 052). This website provides factual information about the service, and any general advice contained does not take into account your objectives, financial situation or needs. Before making any investment decision, please review the PDS and Target Market Determination available at www.medici.openwealth.net.au/key-documents/. Should you require assistance in determining whether an investment in the service is right for you, you may wish to seek personal advice from an appropriately licensed financial adviser.

"*" indicates required fields