INNOVATION

THEMATIC

20% Income

80% GROWTH

Introducing Future Shapers—an investment avenue tailored to embrace forward-thinking enterprises that hold the key to shaping tomorrow’s landscape.. This is a dynamic investment path designed to prepare for tomorrow’s successes today. Seize growth, nurture global views, chart a prosperous path.

These transformative industries possess the potential to reshape the world through their innovative products, services, and business models. Naturally, tapping into these trends ahead of time can offer substantial opportunities for investors.

Central to the Future Shapers Portfolio is a nuanced allocation strategy. Domestic and international equities are thoughtfully weighted, guided by themes and technologies poised to carve the trajectory of future economies. This visionary perspective ensures that investors can leverage the power of transformative industries, capitalising on the tide of emerging trends that redefine progress.

Future Shapers is a strategy for anyone who wants to be part of building a brighter world with life-changing and innovative technology, exciting new social initiatives, and visionary ventures that can change the shape of the future. This portfolio isn’t just an investment; it’s an active participation in shaping the future.

Investing in emerging trends is exciting, not only because it has such a strong possibility of promising returns, but because investors are playing their part in history by contributing to revolutionary innovation investments. These investments can contribute to building a better world with a myriad of possibilities.

The Future Shapers Portfolio actively seeks out opportunities within a diverse spectrum of transformative themes and industries. This includes identifying emerging sectors that are poised to reshape global landscapes, such as sustainable technologies, renewable energy, healthcare innovations, and consumer behavioural shifts. We also look to participate in emerging markets that are undergoing major cultural and economics shifts, set to greatly influence the future landscape. Countries like China, India, and other developing markets demonstrating potential for substantial growth and innovation.

That said, this style of investing does hold risks, as the concept centres around investing early into industries and markets that may still be in their infancy. Our role is to find the themes or assets poised to shape the future and navigating the risks to our investors. We work to invest in themes which are innovative, have scalable ecnomics, and adapt quickly to a rapidly evolving landscape.

The following tabs offers a glimpse into the diverse range of companies included in our portfolio, from emerging leaders to industry titans. It’s important to note that these examples represent just a fraction of the upto 200 companies investors gain exposure to within the portoflio, typically held across ETFs or Managed Funds.

This sneak peek aims to provide investors with an understanding of the types of innovative themes we follow and the breadth of our investment strategy.

Microsoft stands as a cornerstone in AI’s evolution, not only through Azure’s vast cloud capabilities enabling AI and analytics but also as OpenAI’s key partner.

Microsoft provides substantial investment and computational resources to fuel pioneering AI research and innovation, essential for driving future technological advancements.

After commencing a core business model targeting graphics and gaming, NVIDIA has transformed into a leader in AI and deep learning with its powerful GPUs driving advancements in machine learning, autonomous vehicles, and data centers.

NVIDIA’s powerful GPUs and AI platforms are crucial for processing massive data sets efficiently, making advanced machine learning and AI more accessible across industries and applications.

ASML is critical to AI’s infrastructure, providing photolithography systems needed for producing advanced semiconductors that enable cutting-edge AI computing capabilities.

A lithography machine is essentially a highly sophisticated printer used in the manufacturing of computer chips.

Bitcoin represents the growing acceptance of digital assets, and taps into the blockchain technology’s transformative economic potential. This exposure is obtained via an ETF on the ASX; combining secure storage and liquidity.

Coinbase, as a leading cryptocurrency exchange platform, offers direct exposure to the blockchain and digital currency revolution, highlighting innovation and growth in decentralized financial services within our portfolio.

Block, Inc., formerly known as Square, Inc., is a financial services and digital payments company. It facilitates payment processing solutions, peer-to-peer money transfer, and flexible business finance options through its multiple platforms. Its integration of blockchain technology with Square’s Cash App allows users to buy and sell Bitcoin.

CRISPR Therapeutics is pioneering gene-editing, utilising CRISPR/Cas9 technology to develop gene-based medicines for serious diseases, fundamentally altering the field of genetic medicine.

CRISPR/Cas9 is a revolutionary tool that edits genes, enabling scientists to alter DNA sequences and modify gene function for research or medical use.

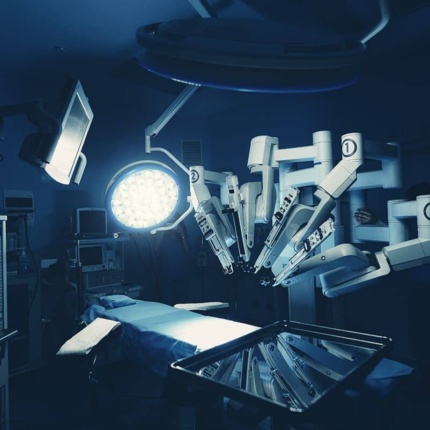

Intuitive Surgical Inc. is a pioneer in the field of robotic-assisted, minimally invasive surgery. The company’s flagship product, the da Vinci Surgical System, was one of the first of its kind to be approved by the FDA and has transformed the way surgeries are performed.

Their continuous innovation in medical technology, training, and services has positioned them as a leader in the healthcare sector, especially in the surgical robotics space.

Uber revolutionised personal transport and the gig economy by introducing a rideshare platform, leveraging technology to connect drivers with passengers efficiently.

Uber is further expanding its disruptive efforts into food delivery with Uber Eats, freight shipping with Uber Freight, and exploring car rental and advertising services.

Founded over two decades ago by renowned innovator Elon Musk, Tesla has surged to the forefront of the EV market with its commitment to sustainable transportation and advanced energy storage solutions.

With global EV adoption still in its early stages, market leaders like Tesla and BYD have significant growth potential. Both companies are expected to play pivotal roles in shaping the future of the automotive industry.

BYD stands as a major electric vehicle manufacturer, offering a diverse range of cars, buses, and trucks, as well as batteries, furthering the EV revolution.

With global EV adoption still in its early stages, market leaders like Tesla and BYD have significant growth potential.

Samsung plays a pivotal role within the expansion of the EV industry, providing advanced lithium-ion batteries that are crucial for powering a wide range of electric vehicles.

Amazon is the titan of e-commerce, setting the global standard for online shopping with its vast product selection, innovative delivery solutions, and cloud services platform.

Visa and Mastercard are pivotal in e-commerce, providing secure, reliable digital payment solutions that facilitate seamless transactions worldwide, essential for online marketplaces.

Shopify empowers merchants with user-friendly tools to build online stores, making e-commerce accessible to businesses of all sizes and driving market diversity.

Danish company Vestas is a global leader in manufacturing wind turbines, providing modern energy solutions that contribute to a significant reduction in carbon emissions.

Their innovations in wind energy technology make them a key player in the renewable energy sector, ideal for the Future Shapers portfolio’s energy transition exposure.

Ecolab offers water, hygiene, and energy technologies and services that ensure clean water, safe food, abundant energy, and healthy environments.

Their solutions in water treatment and energy reduction support sustainable operations across industries, aligning with the Future Shapers portfolio’s dedication to environmental sustainability and energy efficiency.

As the world’s largest producer of wind and solar energy, NextEra Energy is a driving force behind the shift to renewable energy. They are not only leading the charge in clean energy generation but also in energy storage.

TSMC is the world’s premier semiconductor foundry, pivotal for manufacturing advanced chips that power a wide range of technologies. Their innovative approach and capacity to supply critical components make them a strategic asset within the Future Shapers portfolio’s Emerging Markets theme.

Tencent is a Chinese multinational conglomerate, offering services in social networks, music, web portals, e-commerce, mobile games, and payment systems. As a dominant force in the digital space and a key contributor to the tech ecosystem in emerging markets such as China.

PDD Holdings is a leading Chinese e-commerce platform known for its value-for-money merchandise and interactive shopping experience.

Temu is the international wing of PDD Holdings, known for its deep-discount e-commerce platform. It leverages a network of suppliers to offer low prices, free shipping, and additional discounts, appealing to consumers worldwide with a gamified shopping experience.

Data centers are facilities housing computer systems and associated components, such as telecommunications and storage systems. They are critical for the infrastructure around cloud computing, handling the storage, management, and dissemination of data.

In the broader property sector, data center REITs (Real Estate Investment Trusts) are a specialised growth area, providing infrastructure crucial to the digital economy’s backbone.

Green Buildings prioritse sustainability through energy efficiency, environmentally friendly construction processes, and materials that reduce carbon footprints. This sub-sector enhances the broader property sector by meeting stringent standards for energy and environmental design.

Green Buildings are an excellent fit for the Future Shapers portfolio, aligning with global trends towards sustainability.

These sub-sectors form the core of the property sector, encompassing warehouses, shopping spaces, and housing. Each responds differently to economic changes, providing diversification.

They’re key to Future Shapers for their foundational role in economic infrastructure and potential for long-term growth across varied market conditions.

Our Investment Committee Team manages our future-focused investing strategy carefully with a combination of in-depth research, forward-thinking analysis, and continual risk mitigation. We constantly stay informed about emerging trends, technologies, and industry developments to ensure that our Future Shapers Portfolio is perfectly balanced.

It involves identifying disruptive trends and allocating capital to forward-thinking ventures that are pioneering these changes. Such disruptive trends can include advancements in artificial intelligence, biotechnology innovations, renewable energy technologies, e-commerce tech, and the rapid digitisation of traditional industries like agriculture.

Maintaining diversified portfolios is essential for risk management. It can help in reducing exposure to individual risks and creating a robust investment mix. With strategic allocations to asset classes such as fixed income, property, and utilities, this diversified approach enhances risk management and provides investors with a well-rounded investment strategy. With our Future Shapers portfolio, we conduct thorough research to ensure that we strike a balance between disruptive investments and more traditional, stable assets to manage risk effectively.

At Medici Invest, we have a dedicated Investment Committee Team who are incredibly agile. They have the ability to adapt swiftly to market changes, enabling them to optimise portfolio performance and minimise risk effectively. We can promptly rebalance our portfolios when needed, optimising asset allocation and maintaining performance targets.

The asset allocation of the Future Shapers portoflio is closely tied to the Galileo Model Portoflio, which both share a 80/20 asset split. This ensures that we mirror our collective desicion making as a commitee across all portoflios.

The Future Shapers investor:

Model Name | Model Inception Date | 1 Month | 3 Months | 6 Months | 1 Year | Since Inception (annualised) | Future Shapers | 21 Feb 2024

| -0.72% | 3.58% | 15.28% | 16.42% | 15.32% |

|---|

The Future Shapers Portfolio targets investments in the evolving landscape of tomorrow, anticipated to experience profound structural changes. It seeks out visionary companies, industries and emerging markets that are poised to transform how we live through innovative products, services, or business models. If you’d like to learn more, check out our blog how to invest in new technology.

Disruption investing seeks to identify and capitalise on emerging trends and innovations that have the potential to significantly alter the way businesses operate, create new markets, or render existing ones obsolete.

For savvy investors looking to diversify their portfolios and capitalise on emerging market, investing in India India offers robust growth prospects, driven by rapid industrialisation, a burgeoning tech sector, and a dynamic consumer market. Learn more in our blog how and why you should invest in India.

General Advice Warning: Our model portfolios are available from OpenInvest Limited (ACN 614 587 183) via the OpenInvest Portfolio Service (ARSN 628 156 052). The content of this website is intended to be general information only and does not take into account your individual objectives, financial situation, needs or circumstances. You should consider whether investing in a Medici Invest model portfolio is appropriate for you having regard to your objectives, financial situation, needs and circumstances and, if necessary, seek advice from an appropriately qualified financial adviser. You should read the Product Disclosure Statement and Target Market Determination before investing.

If you require assistance in determining whether an investment is right for you, you will need to speak to us about obtaining personal advice, which falls under our Lanteri Partners Financial Management service offering because it will be tailored specifically for you. The Medici Invest investing service is provided within OpenWealth, and via the OpenInvest Portfolio Service, ARSN 628 156 052, an IDPS-like managed investment scheme registered with ASIC under the Corporations Act and issued by Responsible Entity and Administrator, OpenInvest Limited (ACN 614 587 183, AFSL 504 155).

Medici Invest is distributed by Lanteri Partners Financial Management Pty Ltd (ACN 060 748 594, AFSL 239 127) and administered by OpenInvest Limited (ACN 614 587 183) via the OpenInvest Portfolio Service (ARSN 628 156 052). This website provides factual information about the service, and any general advice contained does not take into account your objectives, financial situation or needs. Before making any investment decision, please review the PDS and Target Market Determination available in the Medici Invest portal under Key Documents. Should you require assistance in determining whether an investment in the service is right for you, you may wish to seek personal advice from an appropriately licensed financial adviser.

Your Investment Journey Starts Here

Complete the form to dive into your personalised investment dashboard.

Browse the platform and explore exclusive portfolio offerings tailored for you.

"*" indicates required fields

"*" indicates required fields