This content is for informational purposes only and does not constitute financial advice. It does not take into account your specific objectives, financial situation, or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

This blog was published on the 01/09/2024 and can’t guarantee the accuracy of the information regarding Spaceship and Raiz. Please ensure that you check out the Spaceship and Raiz websites directly before making a decision.

The rise of online investment platforms has revolutionised the way Australians approach their financial futures.

Choosing the right platform can significantly impact your investment success and long-term financial goals.

In this comparison, we’ll take a closer look at Spaceship and Raiz, two of the more recognisable platforms available, and introduce Medici Invest.

A powerful alternative that provides access to sophisticated investment portfolios, previously only accessible to high-net-worth individuals.

By understanding the differences in investment options and fees, you’ll be better equipped to make an informed decision on which platform aligns best with your financial goals.

All of Raiz’s investment options are managed portfolios, featuring a mix of exchange-traded funds (ETFs).

This is designed to simplify the investment process for users, offering a diversified approach that aligns with their risk tolerance and financial goals without the need for hands-on management.

As mentioned, Raiz allows for micro-investing, making investing accessible to people with limited disposable income or savings.

With a minimum contribution of just $5, users can invest either lump sum or recurring deposits depending on their financial situation.

Another cool feature is the round-up option which when activated, automatically rounds up your everyday transactions to the nearest dollar, investing the spare change into your Raiz portfolio.

Additionally, Raiz Rewards offers cashback from partner companies, which is automatically invested into your account.

Below are the investment options available to users:

Standard | Five original portfolios tailored to different risk levels, ranging from Conservative to Aggressive. |

Emerald | Focuses on socially responsible investments, ideal for those seeking ethical investing options. |

Sapphire | Includes a 5% allocation to Bitcoin, providing an easy way to gain cryptocurrency exposure. |

Property | Features a 30% allocation to the Raiz Property Fund, allowing micro-investing in Australian real estate. |

Plus | Customisable portfolio option, enabling users to build their own portfolio from a selection of ETFs, ASX-listed stocks, up to 5% Bitcoin, and up to 30% in the Raiz Property Fund. |

Spaceship is a popular choice among younger investors, particularly those new to investing.

Launched in 2016, the platform has quickly gained traction by offering easy access to diversified portfolios and the US stock market through its mobile app.

Spaceship’s voyager investment portfolios focus on technology-driven companies and they have positioned themselves as a go-to option for investors interested in high-growth sectors.

They also give their clients access to the US market with hundreds of US ETFs and stocks to choose from.

There is no minimum investment for their voyager investment portfolios and only $10 minimum for US shares and ETFs making it an attractive option for beginners looking to dip their toes into the investment world.

Spaceship features 5 voyager investment portfolios including:

Universe Portfolio | A high-growth investment strategy that targets innovative companies that are shaping the future. |

Earth Portfolio | A high-growth investment strategy that’s more focused on sustainability and includes companies that contribute positively to society and the environment whilst still generating profits. |

Origin Portfolio | A high-growth investment strategy that invests in 200 of the largest companies globally and in Australia, focusing on well-established, blue-chip stocks. |

Galaxy Portfolio | A balanced investment strategy that combines lower-risk assets like bonds and cash with growth companies that are poised to benefit from future trends. |

Explorer Portfolio | A conservative investment strategy for cautious investors that prioritises lower-risk investments in bonds and cash while still maintaining some exposure to major global and Australian companies to capture growth opportunities. |

The platform’s user-friendly interface allows users to:

Medici Invest is designed for those who want more than just a basic investment platform.

Offering access to sophisticated portfolios that were once exclusively available to high-net-worth individuals, Medici Invest stands out by making advanced investment strategies accessible to all.

Our platform leverages technology to simplify the investment process, allowing users to open an account and choose from five diversified portfolios within minutes.

Medici Invest’s emphasis on combining ease of use with high-level investment options makes it a strong contender for investors seeking both simplicity and performance.

While there is a minimum investment requirement of $5,000, the value you gain from investing with Medici Invest is substantial.

Our dedicated Funds Management team, with deep expertise in micro and macroeconomic trends, ensures that your investments are guided by professionals who understand the complexities of the financial world.

Our Investment Committee conducts rigorous, ongoing research to identify the best opportunities, continually adjusting strategies to mitigate risks and optimise performance.

By leveraging our strong industry relationships and staying at the forefront of emerging trends, Medici Invest provides a competitive edge, ensuring that our portfolios are aligned with the latest market developments.

This combination of expert management, advanced strategies, and proactive risk mitigation offers investors a unique opportunity to grow their wealth in a well-informed and strategically managed environment.

Here are our 5 investment portfolios:

Our active income investment portfolio is suitable for investors with a lower tolerance for risk and a preference for income generation over capital appreciation. | |

Our moderate growth investment portfolio is suitable for investors who want a balanced mix of risk and return, offering moderate growth and downside protection. | |

Our high-growth investment portfolio is tailored for investors willing to embrace higher risk for potential substantial long-term growth, and it is best suited for those with a long investment horizon. | |

A high-growth investment portfolio that focuses on industries and organisations that are at the forefront of the transition to renewable energy and best positioned to be leaders of the energy transition. | |

A high-growth investment portfolio targets innovative, future-oriented companies poised for significant growth focusing on sectors such as AI, fintech, biotechnology and renewable energy. |

Understanding the fee structures of different investment platforms is crucial, as fees can directly impact your investment returns.

Raiz operates with a simple and transparent fee structure:

Raiz’s structure is particularly beneficial for users who prefer micro-investing and consistent contributions through its round-up feature.

Spaceship offers two main products: Spaceship Voyager and Spaceship US Investing.

Spaceship’s fee structure is designed to be accessible, especially for new investors with smaller balances.

Medici Invest charges a 1.00% per annum management fee, covering our active management approach.

This includes ongoing portfolio monitoring, tactical asset allocation, and regular rebalancing to optimise returns and manage risk.

Our dedicated Investment Committee conducts in-depth research and adjusts your portfolio based on market conditions, ensuring it aligns with the best opportunities.

This fee ensures your investments are professionally managed, with a focus on maximising returns while mitigating risks in a dynamic market environment.

At the end of the day, the right investment platform for you depends on your financial goals, risk tolerance, and how involved you want to be in managing your investments.

Here’s a quick guide to help you decide between Spaceship, Raiz, and Medici Invest:

Ready to begin your investment journey with Medici Invests?

Check out our investment portfolios and choose the right strategy for your needs.

Once you’ve decided, follow these simple steps to get started:

Step 1: Click this get started link

Step 2: Create an OpenWealth account

Step 3: Go to our products tab and select the portfolio that’s right for you

Step 4: Enter the amount of money you’d like to invest

Step 5: Choose your account type

Step 6: Answer the onboarding questions – it should take less than 5 minutes

Step 7: Transfer your funds through BPAY or via direct bank transfer

Step 8: You’re good to go! Monitor your sustainable investment portfolio through the app or online portal

It’s that simple!

If you’d like to speak directly with the Medici Invest team, give us a call on (03) 9637 1608 or contact us online to learn more about how our portfolios are a must-have as a part of your overall investment strategy!

The robotics industry is evolving rapidly, offering investors unique opportunities to capitalise on cutting-edge technology.

With automation transforming industries like healthcare, manufacturing, and logistics, investing in robotics has the potential for significant long-term returns.

This guide explores why robotics is a smart investment choice, the companies we’re personally invested in, and how you can get started with minimal risk.

The rapid advancements in artificial intelligence (AI), machine learning, and sensor technology are the driving forces behind modern robotics.

These innovations are enabling robots to perform increasingly complex tasks with greater precision and autonomy.

AI allows robots to learn from their environments, improving decision-making capabilities and adapting to changing conditions.

Machine learning further enhances this by enabling robots to refine their actions over time, becoming more efficient and capable.

Additionally, sensors play a crucial role, giving robots the ability to perceive their surroundings in real time.

Whether it’s navigating through a warehouse, assisting in delicate surgeries, or performing precision tasks in manufacturing, sensors combined with AI ensure that robots can work safely and efficiently in unpredictable environments.

These technological breakthroughs are making robots more versatile, leading to broader applications across industries and driving the growth of the robotics market.

As these technologies evolve, they will continue to expand the capabilities of robots, offering even more potential for innovation and investment opportunities.

The global robotics market is on a steep growth trajectory, with forecasts predicting exponential expansion in the coming years.

The robotics market size is projected to grow from USD 64.8 billion in 2024 to USD 375.82 billion by 2035 at a compound annual growth rate (CAGR) of 17.33%.

This growth is not limited to industrial robots; service robots, autonomous vehicles, and medical robots are also contributing to the surge.

The adoption of robots in sectors like healthcare, logistics, and manufacturing is rapidly increasing as companies seek to improve efficiency and reduce costs.

As labour shortages and the need for sustainable practices rise, businesses are turning to robotics to fill the gaps, creating a strong demand for innovation in the field.

For investors, this offers a prime opportunity to capitalise on a burgeoning market with long-term potential.

With technology continually advancing, the scope for robotics to revolutionise multiple industries is vast, making it a key area of focus for forward-thinking investors.

While robotics has traditionally been associated with industries like manufacturing and logistics, it is increasingly becoming a part of everyday life.

From robotic vacuum cleaners in homes to advanced surgical robots in hospitals, the integration of robotics into daily routines is expanding.

These technologies are improving convenience, safety, and efficiency in ways we may not always notice.

In healthcare, robots are assisting with surgeries, rehabilitation, and even patient care, reducing the workload for medical professionals and enhancing patient outcomes.

In retail, robots are helping with inventory management and improving customer service through automation.

Autonomous vehicles, drones, and delivery robots are also poised to transform transportation and logistics, reducing delivery times and operational costs.

As robotics continues to evolve, its applications in daily life will become more widespread.

This shift opens new investment opportunities in consumer-facing technologies that leverage automation to improve quality of life.

The potential for robotics to seamlessly integrate into everyday tasks makes it a promising area for future growth and innovation.

The future of robotics promises groundbreaking innovations that will push the boundaries of what robots can do.

One of the most exciting areas is nanorobotics, where microscopic robots are being developed for medical applications such as targeted drug delivery, minimally invasive surgeries, and advanced diagnostics.

These tiny robots hold the potential to revolutionise healthcare by treating diseases at a cellular level.

Another promising development is soft robotics, which involves creating robots with flexible, adaptable structures.

These robots can mimic the movements of biological organisms, making them ideal for delicate tasks such as working alongside humans or handling sensitive materials in industries like agriculture and healthcare.

In the realm of exploration, space robotics is set to play a significant role.

Robots are already being used for planetary exploration, and future missions will increasingly rely on autonomous systems for tasks like building infrastructure on the Moon or Mars.

These innovations not only open up new frontiers for space exploration but also create investment opportunities in the aerospace sector.

As these technologies develop, they will give rise to entirely new markets and applications, offering investors the chance to be part of industries that are set to reshape the world.

At Medici Invests, we strategically focus on investment funds and ETFs that provide diversified exposure to cutting-edge technologies, including robotics and artificial intelligence (AI).

Rather than investing in individual companies, we allocate our resources into two key vehicles that capture a broad range of disruptive innovations.

The Nikko AM ARK Disruptive Innovation Strategy is designed to capitalise on the growth potential of disruptive technologies.

This strategy targets breakthrough advancements across industries, including robotics, AI, blockchain, and genetic engineering.

Within the Nikko AM ARK Disruptive Innovation Strategy, several companies provide significant exposure to the rapidly evolving field of robotics.

These companies exemplify the disruptive innovation in robotics that the fund seeks to capitalise on. With a forward-thinking approach, this fund seeks to invest in companies that are driving transformative change in their respective fields.

The strategy is managed in partnership with ARK Invest, which is known for its deep expertise in identifying high-growth opportunities in emerging markets.

By investing in this strategy, Medici Invests provides access to a wide array of innovation leaders, positioning clients to benefit from long-term market shifts.

The Global Robotics and Artificial Intelligence ETF from BetaShares is another key component of our investment portfolio.

The RBTZ Global Robotics and Artificial Intelligence ETF provides exposure to some of the leading companies driving advancements in robotics and AI.

These companies collectively showcase the ETF’s focus on the intersection of robotics and artificial intelligence, positioning investors at the forefront of technological disruption.

It includes established market leaders as well as emerging players, providing investors with a balanced and diversified exposure to the global robotics and AI market.

The ETF’s focus on companies driving innovation in automation makes it an ideal choice for those looking to invest in the future of technology.

By investing in these funds, Medici Invests ensures that clients gain access to a broad range of opportunities in the fast-growing fields of robotics and AI, without the risk associated with picking individual stocks.

If you’re ready to invest in quantum computing, don’t risk putting all your eggs in one basket.

Our Future Shapers portfolio offers exposure to leading companies in robotics and AI, alongside other cutting-edge firms pushing advancements in automation.

This ensures a well-rounded, diversified investment approach, reducing risk while maximising potential returns.

We leverage in-depth research, forward-thinking analysis, and ongoing risk management to maintain portfolio stability and growth.

Our team continually monitors emerging trends and technological developments to ensure our Robotics Innovators portfolio is well-positioned for success in the evolving market.

To get started:

Step 1: Click this get started link

Step 2: Create an OpenWealth account

Step 3: Go to our products tab and select the Future Shapers portfolio.

Step 4: Enter the amount of money you’d like to invest

Step 5: Choose your account type

Step 6: Answer the onboarding questions – it should take less than 5 minutes

Step 7: Transfer your funds through BPAY or via direct bank transfer

Step 8: You’re good to go! You’ll be able to monitor the performance of your investment portfolio directly through the app or your online portal.

It’s that easy!

If you’d like to speak directly with the Medici Invest team, give us a call on (03) 9637 1608 or contact us online to learn more about how this portfolio is a must-have as a part of your overall investment strategy!

Investing $50,000 can be daunting, especially with countless options and potential risks.

Many new investors find themselves unsure of where to begin, overwhelmed by the choices, and worried about making the wrong decision.

Imagine having a clear strategy that simplifies your investment journey and maximises your returns.

Understanding the best ways to invest $50,000 in Australia can help you confidently grow your wealth and secure your financial future.

At Medici Invests, we specialise in creating sophisticated and accessible investment portfolios that were previously reserved for full-service clients.

This guide will explore two robust approaches to investing your $50,000, ensuring you make the most of your investment.

Our first strategy includes investing $25,000 in either our Future Shapers Portfolio or Green Horizons Portfolio and investing the remaining $25,000 into our Michelangelo Portfolio.

This strategy allows you to diversify across our more innovative and stable portfolios, reducing overall risk while positioning yourself for potentially high returns.

We’ve provided a breakdown of the differences between each portfolio below:

Ideal For: Investors seeking exposure to cutting-edge advancements and companies shaping the future.

The Future Shapers Portfolio targets innovative, future-oriented companies poised for significant growth.

This portfolio focuses on sectors such as technology, biotechnology, and renewable energy.

Investing $25,000 in this portfolio provides exposure to cutting-edge advancements and companies that are shaping the future.

Expected returns are high, but investors should be prepared for a higher level of risk due to the innovative nature of these sectors.

Ideal for: Investors passionate about sustainable initiatives but still want to see a strong return on investment.

The Green Horizons Portfolio focuses on industries and organisations at the forefront of the transition to renewable energy and best positioned to benefit from this industrial evolution.

This strategic emphasis ensures our portfolio is aligned with future growth and sustainability trends, maximising returns while supporting the global shift towards cleaner energy solutions.

This portfolio aims for steady returns with a focus on sustainability, offering a balanced risk profile.

Like the Future Shapers Portfolio, expected returns are high, but there is a higher level of risk due to the concentrated nature of the companies and sectors we’re invested in.

Ideal for: Investors who prefer predictable recurring income or don’t want to take big risks.

The Michelangelo Portfolio focuses on established, high-performing companies with a track record of stability and growth.

This portfolio includes blue-chip stocks and large-cap companies known for their reliable performance and strong market presence.

This portfolio typically has an allocation of 40% income and 60% growth. This means that 40% of the portfolio is allocated to income-generating investments, such as bonds or dividend-paying stocks, which provide regular returns.

The remaining 60% is allocated to growth-oriented investments, such as stocks or equity funds, which aim to increase in value over time.

The Future Shapers Portfolio or Green Horizons Portfolio on the other hand have a 20% income and 80% growth allocation which is a lot more aggressive but provides the opportunity to maximise your return on investment in a safer manner than investing in individual stocks.

By investing the remaining $25,000 in the Michelangelo Portfolio, you’ll be invested in a more balanced strategy that’s positioned for both stability and high returns, mitigating risks associated with market volatility and sector-specific downturns.

For those who prefer a more concentrated investment approach, our second recommended investment strategy is to invest the entire $50,000 into one of our specialised portfolios.

This method allows for focused growth and simplifies management by concentrating your funds in a single investment area.

You could choose one of the 3 portfolios we’ve already discussed:

Or, you could invest in either of our other 2 portfolio options:

Ideal for: Investors who want a more stable investment option while still seeing moderate returns.

The Da Vinci Portfolio is a moderate growth investment option designed for those seeking a balanced mix of income and capital appreciation.

This portfolio strategically balances risk and return with a 30% income and 70% growth allocation.

It includes a diversified mix of assets such as stocks, bonds, and property, aiming for moderate growth while providing some downside protection.

This makes it suitable for investors who prefer a stable investment with steady returns, catering to a wide range of ages and risk tolerances.

Ideal for: investors that are prepared to accept a higher degree of risk, or with a longer investment horizon to withstand market volatility.

The Galileo Portfolio focuses on high growth, targeting sectors with substantial long-term potential.

This portfolio embraces calculated risks for higher returns with an 80% growth and 20% income allocation.

By concentrating your entire $50,000 investment in one of these portfolios, you can align your strategy with your specific financial goals and risk appetite, leveraging Medici Invests’ expertise to navigate the investment landscape effectively.

Before diving into any investment strategy, it’s crucial to assess your risk tolerance and clearly define your investment goals.

Are you looking for long-term growth, short-term gains, or a mix of both?

Understanding your risk tolerance will help you choose the right portfolios and investment strategies that align with your comfort level and financial objectives.

If you have a lower risk tolerance, investing your entire $50,000 into the Michelangelo Portfolio is a great option for stable returns.

If you want to be a bit more aggressive but not overly risky, you should consider strategy 1 and allocate $25k to the Future Shapers or Green Horizons Portfolio and allocate the other $25k to the Michelangelo Portfolio.

You could also go for strategy 2 and invest the entire $50k into the Da Vinci Portfolio if you wanted a more simplified investment strategy.

If you’re comfortable with higher risk, we recommend following strategy 2 and investing the entire $50,000 into either the Galileo, Future Shapers or Green Horizons Portfolio.

To help determine your risk appetite, we offer a risk profile questionnaire tool on our website. This tool can guide you in understanding your risk tolerance better and assist in making informed investment decisions. Remember, this information is not intended as financial advice, and the final decision ultimately depends on your personal circumstances and judgment.

The length of time you plan to invest your $50,000 plays a significant role in your strategy.

If you have a long-term horizon, you may be more inclined to invest in higher-risk, high-reward portfolios like the Future Shapers or Green Horizons Portfolio.

However, if you are looking for more immediate returns or have a shorter investment horizon, the stability and income generation of the Michelangelo Portfolio might be more suitable.

Navigating the investment landscape can be complex, and professional advice can be invaluable.

If you’d like to speak with us directly about what strategy would work best for you, call (03) 9637 1608 or contact us online so we can help you determine your ideal investment strategy!

Ready to begin your investment journey with Medici Invests?

Follow these simple steps to get started:

Step 1: Click this get started link

Step 2: Create an OpenWealth account

Step 3: Go to our products tab and select the Green Horizons portfolio

Step 4: Enter the amount of money you’d like to invest

Step 5: Choose your account type

Step 6: Answer the onboarding questions – it should take less than 5 minutes

Step 7: Transfer your funds through BPAY or via direct bank transfer

Step 8: You’re good to go! Monitor your sustainable investment portfolio through the app or online portal

It’s that simple!

Investing in India from Australia presents a promising opportunity for savvy investors looking to diversify their portfolios and capitalise on emerging markets.

As one of the fastest-growing economies in the world, India offers robust growth prospects, driven by rapid industrialisation, a burgeoning tech sector, and a dynamic consumer market.

Moreover, global shifts in supply chains away from China are positioning India as a key player on the global stage.

This guide explores why India is an attractive investment destination, the best sectors to consider, and the practical steps Australian investors need to take to enter the Indian market confidently.

If the Future Shapers portfolio sounds like an investment strategy you’re interested in, you can complete the application process in less than 5 minutes.

To get started:

It’s that simple!

If you have any questions, don’t hesitate to call us on (03) 9637 1608 or via our online contact form.

Once considered a sluggish and underperforming economy, India’s economy is now one of the fastest-growing in the world. Despite global economic challenges, India’s experienced a GBP growth rate of 7.8% in 2023, compared to the United States (2.5%) and Australia (2.1%).

With a population of over 1.3 billion, India boasts a vast consumer market that is increasingly affluent and aspirational. This expanding middle class, coupled with a young and tech-savvy workforce, has fueled demand for a wide range of products and services, creating lucrative opportunities across various sectors.

One of the key drivers of India’s economic growth has been the technology and services industries. The country has emerged as a global hub for information technology (IT) services, software development, and business process outsourcing (BPO). Major multinational corporations such as Microsoft, Apple, and IBM have established operations in India, attracted by the availability of skilled labour and cost-effective solutions.

Moreover, India’s manufacturing sector has gained significant momentum in recent years. Initiatives such as “Make in India” have aimed to position the country as a global manufacturing hub by encouraging both domestic and foreign companies to set up manufacturing units.

With a vast domestic market, a skilled workforce, and a pro-business government, India presents a compelling investment opportunity for Australian investors seeking to diversify their portfolios and tap into the potential of an emerging economic powerhouse.

One of India’s most significant advantages lies in its demographic profile, which presents a unique opportunity for sustained economic growth and investment returns. With a median age of just 28.7 years, India boasts a young and rapidly growing population, providing a substantial demographic dividend.

This demographic dividend refers to the economic growth potential that arises from having a large working-age population relative to the dependent population (children and elderly). India’s youthful workforce not only contributes to increased productivity and economic output but also drives domestic consumption and fuels demand across various sectors.

As incomes rise and living standards improve, the middle class is expanding rapidly, creating a burgeoning consumer market for goods and services. This trend has attracted significant investment from both domestic and international companies seeking to capitalise on India’s growing purchasing power.

Additionally, India’s demographic profile has contributed to a skilled and tech-savvy workforce. The country has a large pool of educated and talented individuals, particularly in fields such as engineering, technology, and healthcare. This human capital has been a driving force behind India’s success in sectors like information technology, biotechnology, and pharmaceuticals, making it an attractive destination for investment in these industries.

In recent years, a significant shift has been observed in global supply chains, with many developed economies, including the United States, actively seeking to reduce their reliance on China for manufacturing and sourcing needs. This strategic move has been driven by a combination of factors, including geopolitical tensions, trade disputes, and the vulnerabilities exposed by the COVID-19 pandemic.

The disruptions caused by the pandemic highlighted the risks associated with an over-reliance on a single country or region for critical supply chains. As a result, companies and governments alike have recognised the importance of diversifying their supply chains and building resilience to mitigate future shocks.

India has emerged as a prime beneficiary of this shift, positioning itself as a favorable alternative to China for global manufacturing and sourcing operations.

Several factors contribute to India’s attractiveness in this regard:

As companies seek to diversify their supply chains and reduce their dependence on China, India’s favourable conditions, including its skilled workforce, domestic market potential, and government support, make it an attractive destination for investment and manufacturing operations.

By capitalising on this shift in global supply chains, Australian investors can potentially benefit from the growth opportunities presented by India’s expanding manufacturing and logistics sectors, as well as the increased demand for goods and services catering to the country’s burgeoning consumer market.

If you’re looking to invest in India but aren’t sure which company or ETF to invest in, the Future Shapers portfolio has our highest exposure to Indian companies that are at the forefront of shaping tomorrow’s landscape.

It allows you to invest early in transformative industries, companies and economies.

This portfolio provides exposure to up to 200 companies and combines in-depth research, forward-thinking analysis, and continual risk mitigation.

We constantly stay informed about emerging trends, technologies, and industry developments to ensure that this portfolio is perfectly balanced to succeed.

As part of our strategic investment approach, we have carefully selected a portfolio of Indian companies that align with our investment philosophy and offer promising growth prospects.

Indian companies with exposure in the Future Shapers portfolio:

Adani Enterprises Ltd is the flagship company of the Adani Group, with a diversified business portfolio spanning sectors such as resources, logistics, agribusiness, and energy.

A significant appreciation in their share price has cemented the company’s status as a powerhouse in India’s rapidly evolving business landscape.

Adani Enterprises Ltd, the flagship company of the Adani Group, presents an attractive investment opportunity due to its diversified business model spanning resources, logistics, agribusiness, and energy sectors.

This diversification provides a hedge against industry-specific risks, ensuring a more stable revenue stream and growth potential.

Furthermore, the company’s strong focus on infrastructure development aligns with India’s ambitious plans for infrastructure upgrades and economic growth, positioning it to benefit from increased government spending and private investments in this sector.

Adani Enterprises has also made significant investments in renewable energy projects, including solar and wind power generation, which hold promising growth prospects as India transitions towards a more sustainable energy mix.

Additionally, the company’s active pursuit of international expansion, particularly in the mining and resources sector, diversifies its revenue streams and provides access to new markets, further enhancing its investment appeal.

Adani Green Energy Ltd, a leading renewable energy company in India, is well-positioned to capitalise on the country’s commitment to increasing its renewable energy capacity, presenting a significant growth opportunity.

Their share price has grown over 4,700% in the last 5 years, reflecting the company’s remarkable growth trajectory and investor confidence in its prospects.

The company’s focus on solar and wind power generation aligns with the Indian government’s implementation of various incentives and policies to promote renewable energy adoption, such as tax credits, subsidies, and renewable purchase obligations.

These favourable policies support the growth of companies like Adani Green Energy. Moreover, the company’s investments in cutting-edge renewable energy technologies, including solar tracking systems and efficient wind turbines, demonstrate its commitment to innovation, which can enhance its competitiveness and profitability.

As environmental concerns and the demand for clean energy continue to rise globally, Adani Green Energy’s focus on sustainable energy solutions aligns with global trends, making it an attractive investment for environmentally conscious investors.

Adani Power Ltd, a prominent player in the Indian power generation sector, offers a compelling investment opportunity with its diverse portfolio of thermal and renewable energy assets.

This diversified energy mix provides a hedge against fluctuations in fuel prices and regulatory changes affecting specific energy sources. The company has been implementing measures to enhance operational efficiency and reduce costs, which can improve profitability and competitiveness in the power generation market.

Adani Power also has ambitious expansion plans, including the development of new power plants and the acquisition of existing assets, which can drive future revenue and earnings growth.

Furthermore, the Indian power sector is ripe for consolidation, and Adani Power’s strong financial position and operational expertise make it well-suited to capitalise on potential acquisition opportunities, further bolstering its growth prospects.

Their share price has grown over 1,400% in the last 5 years, a staggering increase that underscores the company’s strong performance and growth potential in India’s rapidly expanding power sector.

These three companies fall within the asset mix of the GQG Partners Emerging Markets Equity Fund, which has over 30% exposure to India. The Medici Invest Future Shapers portfolio has an allocation of this investment vehicle to gain access to these uniquely positioned opportunities.

With their strong fundamentals, innovative approaches, and commitment to sustainable practices, the team at GQG Partners believe these companies are well-positioned to deliver long-term value to our portfolio.

As India continues its trajectory towards becoming a global economic powerhouse, we remain committed to closely monitoring and evaluating our investments, ensuring that they align with our investment objectives and contribute to the overall growth and success of Future Shapers.

Sustainable investing is rapidly gaining traction in Australia as more investors seek to align their financial goals with their values and contribute to a better future.

This approach considers environmental, social, and governance (ESG) factors alongside traditional financial metrics when evaluating investment opportunities.

By investing in companies and funds that prioritise sustainability, Australian investors can drive positive change while potentially achieving competitive returns.

With the growing demand for ethical and responsible investments, sustainable investing offers a way to make a meaningful impact while building a diversified portfolio.

At Medici Invest, we provide access to a sophisticated sustainability-focused investment portfolio, typically reserved for full-service clients.

In this comprehensive guide, we’ll explore how to invest in sustainable companies in Australia by evaluating sustainable investment opportunities to find the right companies for your goals and values.

We’ll also discuss our Green Horizons portfolio as well as 6 Australian companies that we believe are at the forefront of the sustainability movement.

To get started:

It’s that simple!

For first-time investors looking to invest in sustainable companies, we recommend that you take the time to clearly define your personal values, ethical principles, and investment goals before deciding on an individual company, ETF or portfolio to invest in.

Establishing your priorities will help guide your investment decisions and ensure alignment with your beliefs.

For example, while sustainable investing and ethical investing are often used interchangeably, there are some key differences between the two approaches:

Sustainable investing takes a broader approach by considering environmental, social, and governance (ESG) factors alongside traditional financial analysis.

The focus is on identifying companies and investments that are well-positioned for long-term success by effectively managing ESG risks and opportunities.

Some key aspects of sustainable investing:

Ethical investing, also known as socially responsible investing (SRI), is primarily values-based. The goal is to align investments with an investor’s ethical principles, moral values, or religious beliefs.

Key points about ethical investing:

While there is some overlap, the main distinction is that sustainable investing takes a more comprehensive approach by evaluating ESG factors, while ethical investing is primarily guided by an investor’s personal values and ethical exclusions.

However, many investors employ a combination of both strategies, using ESG analysis to identify sustainable investment opportunities while also applying ethical screens to avoid misalignment with their core values and beliefs.

Ultimately, this decision is subjective to your personal values, ethical principles, and investment goals and taking the time to self-evaluate will help immensely when evaluating new companies, ETFs or portfolios.

As sustainable investing continues to gain traction, numerous organisations such as MSCI and Sustainalytics have emerged to provide independent assessments and ratings of companies’ environmental, social, and governance (ESG) performance.

While the specific methodologies and criteria may vary across providers, ESG ratings generally assess a company’s performance across a range of factors, such as:

These ESG ratings and reports can be valuable tools for investors seeking to evaluate potential investments through a sustainability lens.

Beyond the numerical ratings, ESG reports often provide valuable qualitative insights into a company’s sustainability practices, risks, and opportunities.

These reports can highlight areas of strength or concern, as well as identify potential controversies or incidents that may impact a company’s ESG performance.

You can use these ratings to compare which companies are meeting key metrics and which ones are falling short.

While ESG ratings can provide a helpful overview, investors should dig deeper to gain a comprehensive understanding of a company’s sustainability approach and performance.

Here are some key areas to investigate when researching a company’s sustainability practices:

Most large public companies publish their own annual sustainability or ESG reports detailing their policies, initiatives, goals, and performance metrics related to environmental, social, and governance issues.

These reports can offer valuable insights into a company’s sustainability strategy, commitments, and progress over time.

Compare these findings with whichever 3rd party ESG organisation you used to research in the last step to find potential inconsistencies.

Review a company’s publicly available policies and codes related to areas like environmental management, human rights, labour practices, ethics, and corporate governance.

These documents outline the principles and standards the company aims to uphold.

Public companies are required to disclose certain ESG-related information in their annual reports, proxy statements, and other regulatory filings.

These can reveal details about a company’s governance structure, executive compensation, environmental compliance, and potential risks or controversies.

Investigate whether a company participates in relevant industry initiatives or has obtained certifications related to sustainability, such as the UN Global Compact, Science Based Targets initiative, or ISO 14001 for environmental management systems.

Monitor news coverage, NGO reports, and other external sources for information about a company’s sustainability performance, controversies, or areas of concern.

This can provide a more balanced perspective beyond the company’s self-reported data.

By thoroughly researching a company’s sustainability practices and policies from multiple credible sources, you can make more informed decisions about whether a particular investment aligns with your values, risk tolerance, and long-term sustainability goals.

While some investors may choose to build their own sustainable investment portfolios by individually researching and selecting companies, investing through professionally managed sustainable funds or pre-built portfolios can offer several advantages including:

At Medici Invest, our Green Horizon portfolio has a dedicated committee team that carefully combines in-depth research, forward-thinking analysis, and continual risk mitigation.

We actively monitor new sustainable trends, technologies, and industry developments to ensure the Green Horizons Portfolio’s asset allocation remains well-positioned based on evolving market conditions.

Please note: Green Horizon isn’t an ESG portfolio. We invest in industries and organisations that are at the forefront of the transition to renewable energy and best positioned to benefit from this industrial evolution.

As part of our commitment to sustainable investing, we’ve carefully selected a diverse range of Australian companies that are driving innovation and progress towards a cleaner, more sustainable future.

Here are six companies in our Green Horizons portfolio that we view as leaders in adopting and innovating sustainable change while still offering attractive investment opportunities:

Boss Energy Ltd. (ASX: BOE) is an Australian uranium exploration and development company focused on the Honeymoon Project in South Australia.

With a commitment to sustainable mining practices, minimising environmental impact, and engaging local communities, Boss Energy provides exposure to uranium – a low-carbon baseload energy source.

Their share price has grown 96.73% in the past year (as of April 16, 2024), and as nuclear power plays a role in the energy transition, Boss Energy is well-positioned to benefit from growing demand while adhering to strict ESG standards.

Lynas Rare Earths Ltd (ASX: LYC) is the only major producer of refined rare earth materials outside China.

These critical minerals are essential for renewable technologies like electric vehicles and wind turbines.

Lynas has implemented industry-leading environmental standards and aims to establish a sustainable rare earths supply chain.

With rising demand for clean energy solutions, Lynas offers exposure to a key enabling resource while prioritising responsible operations and environmental stewardship.

While a traditional fossil fuel company, Santos is taking significant strides towards cleaner energy and sustainability.

The company has committed to achieving net-zero emissions by 2040 and is investing heavily in carbon capture and storage (CCS) technologies.

Santos is also pursuing growth in cleaner fuels like hydrogen and has set ambitious targets for reducing operational emissions.

Meridian Energy is New Zealand’s largest renewable energy generator, with a portfolio focused on wind farms and hydroelectric power stations.

With its exclusive focus on renewable generation assets, Meridian Energy offers investors pure-play exposure to the global transition towards clean energy sources.

The company has an unwavering commitment to sustainability and renewable energy and 100% of its electricity generation is through renewable sources.

The company has experienced 33.67% growth over the past 5 years (as of April 16, 2024) and has been included in our portfolio due to its strong financial performance backed by long-term renewable energy contracts.

Genex Power (ASX: GNX) is an Australian renewable energy company developing a portfolio of pumped hydro, solar and wind projects.

Its flagship Kidston Clean Energy Hub integrates large-scale solar with pumped hydro storage, supporting grid stability.

Genex is pioneering pumped hydro technology and offers exposure to critical energy storage solutions needed for transitioning to higher renewable penetration.

With an experienced team and strong project pipeline including a revenue deal with Tesla for its Bouldercombe big battery in Queensland, Genex provides sustainable investors access to innovative clean energy assets.

This company has seen a 66.88% increase in share price in the last 12 months (as of April 16, 2024).

Origin Energy is one of Australia’s leading integrated energy companies, with operations spanning electricity generation, natural gas production, energy retailing, and renewable energy development.

While Origin has a significant fossil fuel portfolio, the company is taking meaningful steps towards sustainability and the energy transition.

The company has invested heavily in growing its renewable energy portfolio, including large-scale wind, solar, and battery storage projects.

They’ve also invested heavily in Octopus Energy to establish a leading global renewable energy retailer and are developing the Hunter Valley Hydrogen Hub to produce green hydrogen using renewable energy.

For investors seeking exposure to the energy transition within a diversified sustainable portfolio, Origin Energy offers a mix of traditional energy assets providing funding sources, combined with an increasing focus on renewables and low-carbon solutions for the future.

The company has also seen a share price growth of 28.54% over the past five years (as of April 16, 2024).

While researching and selecting individual sustainable stocks can be time-consuming, Medici Invest provides an accessible solution through our Green Horizons portfolio.

Unlike our other portfolios, Green Horizons focuses on industries and organisations that are at the forefront of the transition to renewable energy and best positioned to benefit from this industrial evolution – a fusion of financial wisdom and environmental consciousness.

To get started:

Step 1: Click this get started link

Step 2: Create an OpenWealth account

Step 3: Go to our products tab and select the Green Horizons portfolio

Step 4: Enter the amount of money you’d like to invest

Step 5: Choose your account type

Step 6: Answer the onboarding questions – it should take less than 5 minutes

Step 7: Transfer your funds through BPAY or via direct bank transfer

Step 8: You’re good to go! Monitor your sustainable investment portfolio through the app or online portal

It’s that simple!

By investing in Green Horizons, you’ll gain exposure to a diversified portfolio of companies at the forefront of the sustainability revolution without the hassle of individual stock picking.

Our team of experts continually monitors emerging trends, technologies, and industry developments to ensure your portfolio remains optimally balanced and positioned for success.

Ready to align your investments with your values and contribute to a more sustainable future?

Explore our Green Horizons portfolio and let our team of experts guide you towards responsible investing opportunities.

If you’re ready to invest, click this get started link, create an OpenWealth account and answer the onboarding questions.

If you’d like to speak directly with the Medici Invest team, give us a call on (03) 9637 1608 or contact us online to learn more about how this portfolio is a must-have as a part of your overall investment strategy!

Investing in new technology is a compelling avenue for those looking to diversify their portfolios and tap into the future’s potential.

It embodies the unique advantage of driving progress and potentially generating substantial returns.

While investing in the right companies offers significant growth potential for early investors, if you don’t know what you’re looking for you’ll most likely miss opportunities or make misguided decisions.

Medici Invest provides access to a sophisticated new technology investment portfolio, typically reserved for full-service clients.

Backed by Lanteri Partners, a respected Wealth Management firm that has stood by Australians for decades, we’ve created an advanced new technology investment strategy accessible to all.

Keep reading to learn about how you can invest in our Future Shapers portfolio and begin aligning your investments with the trajectory of the world’s future development.

If you’re ready to invest in new technology, don’t risk putting all your eggs in one basket.

Our Future Shapers portfolio provides exposure of up to 200 companies combining in-depth research, forward-thinking analysis, and continual risk mitigation.

We constantly stay informed about emerging trends, technologies, and industry developments to ensure that our Future Shapers Portfolio is perfectly balanced to succeed.

To get started:

It’s that easy!

If you’re interested in delving deeper into the cutting-edge technologies that have captured our interest, the pioneering companies leading the charge, and the critical factors you should take into account, we’ll provide everything you need to know.

While you’re probably aware of ChatGPT, AI is already utilised across a wide range of sectors.

With its ability to learn from data, adapt to new scenarios, and perform tasks with increasing accuracy over time, we’re only starting to scratch the surface of AI’s potential.

With no signs of slowing down, AI could be worth an extra $315 billion to the Australian economy by 2030.

Investing in the companies at the forefront of this innovation is a sound strategy to financially benefit from this expected growth.

Our Future Shapers portfolio contains a variety of companies that are at the cutting edge of AI innovation including:

Blockchain is far more than just the backbone of cryptocurrency; it’s revolutionising sectors by providing transparency, security, and efficiency.

Particularly in areas like supply chain management and secure transactions, blockchain presents a fertile ground for investment.

Statista predicts that blockchain’s economic value could be worth $943 billion USD by 2032, representing a CAGR of 56.1 percent.

Investors are uniquely positioned to capitalise on this technology as it continues to evolve and reshape entire industries.

With its growth and integration into various sectors, investors can seize the chance to support and partake in innovative projects that leverage blockchain’s unique attributes.

As it moves beyond finance into fields like healthcare, real estate, and digital identity, the potential for sustainable, transformative investments expands, presenting unprecedented opportunities for those ready to engage with this dynamic technology.

Anticipated to grow at a consistent annual rate of 9.82% (CAGR 2024-2028), the market is projected to expand to a value of US$906.7 billion by 2028.

As the EV market matures and expands, its growth potential becomes even more significant.

This growth is not just limited to vehicle sales but extends across the entire supply chain, including battery production, charging infrastructure, and technological innovations aimed at improving range and performance.

Our Future Shapers portfolio reflects this comprehensive approach, covering not just leading EV manufacturers like Tesla and BYD Company Limited but also key players like Samsung, who are spearheading the advancement of lithium-ion batteries crucial for powering these vehicles.

Investing in the energy transition offers a unique blend of benefits that align with both financial growth and environmental sustainability.

Global investment in energy transition hit 1.8 trillion in 2023, up 17% from the previous year as well as Government’s globally having allocated USD 1.34 trillion to clean energy since the pandemic.

The shift towards renewable energy sources like solar, wind, and hydro presents significant growth opportunities, driven by increasing global demand for cleaner and more sustainable energy solutions.

For the first time, we are seeing the investment in solar exceed the investment in oil internationally, reflecting both public demand for cleaner energy as well as Government commitment to sustainable development and carbon reduction goals.

Our Future Shapers portfolio features exposure to this growing sector through companies pioneering this space such as:

By integrating companies like these into our portfolio, we aim to capitalise on the dynamic growth of the clean energy sector, as well as diversify into different green energy technologies to reduce exposure to individual risks and create a robust investment mix.

Investing in biotechnology offers several opportunities for strong returns on investment, primarily due to the sector’s dynamic nature and potential for significant breakthroughs.

Biotechnology is at the forefront of scientific innovation, particularly in health, medicine, and agriculture.

Investments can lead to groundbreaking treatments, vaccines, or farming solutions, which can be highly profitable.

However, it’s important to note that biotech investments can also be risky due to high research and development costs, regulatory hurdles, and the binary nature of clinical trial results.

Therefore, thorough research and a well-considered investment strategy are essential.

To combat this, our Future Shapers portfolio has a dedicated Investment Committee Team who are incredibly agile.

They have the ability to adapt swiftly to market changes, enabling them to optimise portfolio performance and minimise risk effectively.

When considering investments in new technology, it’s essential to approach with both enthusiasm for innovation and a strategic understanding of the associated risks and opportunities.

Here’s a detailed look at things to consider:

Evaluate the potential market size and growth for the new technology.

Consider whether the technology addresses a genuine need or is likely to become a must-have in its intended market.

A larger market potential often translates to higher revenue opportunities.

Assess the competitive environment of the technology sector you are considering.

Identify the key players, their market share, and the unique value proposition of the new technology compared to existing solutions.

Understand whether the technology has a sustainable competitive advantage.

New technology sectors can be heavily impacted by regulatory changes.

Consider the current regulatory environment and any anticipated changes that could affect the market.

For example, data privacy laws have significant implications for tech companies in sectors like cloud computing and AI.

Evaluate the technical feasibility and the stage of development of the new technology you’re looking to invest in.

Consider whether the technology is proven and if there are any major technical hurdles that need to be overcome for it to be successful.

Moreover, it’s important to recognise that not all emerging technologies achieve mainstream adoption.

Some may only enjoy temporary popularity, turning out to be fads.

An example of this phenomenon is 3D printing, which, despite its revolutionary potential, has not become as ubiquitous in consumer applications as initially anticipated.

This underscores the importance of discerning between technologies with lasting impact and those that might not sustain long-term interest or utility.

Analyse the financial health of the company or companies developing the new technology.

Look at their revenue growth, profitability, cash flow, and R&D spending.

Additionally, assess the stock’s valuation to ensure you’re not overpaying for potential future growth.

Consider how quickly the technology is being adopted and any barriers that could slow its adoption, such as high costs, technical complexity, or lack of consumer awareness.

While high adoption rates can signal a technology’s potential success, notable barriers present challenges that necessitate thoughtful strategic approaches to address.

It’s worth noting that investments within the Future Shapers portfolio often reside at the early stages of the S-curve.

This positioning suggests they are in the initial phase of adoption, where growth is starting to accelerate, highlighting the importance of navigating early obstacles to unlock their full potential.

Consider your investment horizon and exit strategy. New technology investments can take longer to mature, so you’ll need to be prepared for a long-term commitment.

For our Future Shapers portfolio, we recommend an investment timeframe of at least 7 years to allow for the full potential of disruptive technologies to unfold and significantly impact the market.

Given the nature of emerging tech, developments and advancements can lead to exponential growth but might require patience to navigate through cycles of innovation and market adoption.

Think about how and when you might exit your investment, particularly if the market environment changes or if the technology fails to meet expectations.

As we embrace the future of new technology, our Future Shapers portfolio offers an unparalleled opportunity to invest in a diverse range of companies leading the way in their respective fields.

If you’re an investor with a higher risk tolerance level, this portfolio has a strong possibility of promising returns, aligning cutting-edge technological advancements with your investment goals for a forward-thinking approach to your financial future.

If you’re ready to invest, click this get started link, create an OpenWealth account and answer the onboarding questions.

If you’d like to speak directly with the Medici Invest team, give us a call on (03) 9637 1608 or contact us online to learn more about how this portfolio is a must-have as a part of your overall investment strategy!

Overview: This article challenges the misconception that millennials and younger generations avoid traditional financial advice, highlighting the transformative impact of strategic financial planning for young professionals. It presents a real-life case study of a young couple’s journey with the Lanteri Partners Group.

In an era where financial autonomy is highly prized, the narrative that younger generations, particularly millennials, are avoiding traditional financial advice in favour of do-it-yourself strategies has gained traction. However, this view overlooks a critical aspect of financial planning: its capacity to transform lives over the long term, something that Lanteri Partners Group has been witnessing as it diversifies its client base to include not just well-established or retired individuals but also ambitious young professionals.

The disconnect between perceived cost and the intrinsic value of financial advisory services has been a significant barrier. Many young professionals struggle to see beyond the immediate expense, failing to recognize the compound benefits of early, strategic financial planning. Superannuation, a cornerstone of financial security in later life, often goes underappreciated until it’s too late. This lack of foresight can result in missed opportunities to leverage one’s financial position for both current satisfaction and future prosperity.

Research from Findex highlights the substantial benefits of professional financial advice, noting a potential $664,000 difference in net assets by retirement for those who seek advice early. Despite recognizing the value of such guidance, a significant gap exists between appreciation and action, with cost cited as a major barrier. This perception challenges the financial industry to evolve, offering more accessible and relevant services to a generation standing on the precipice of a significant wealth transfer.

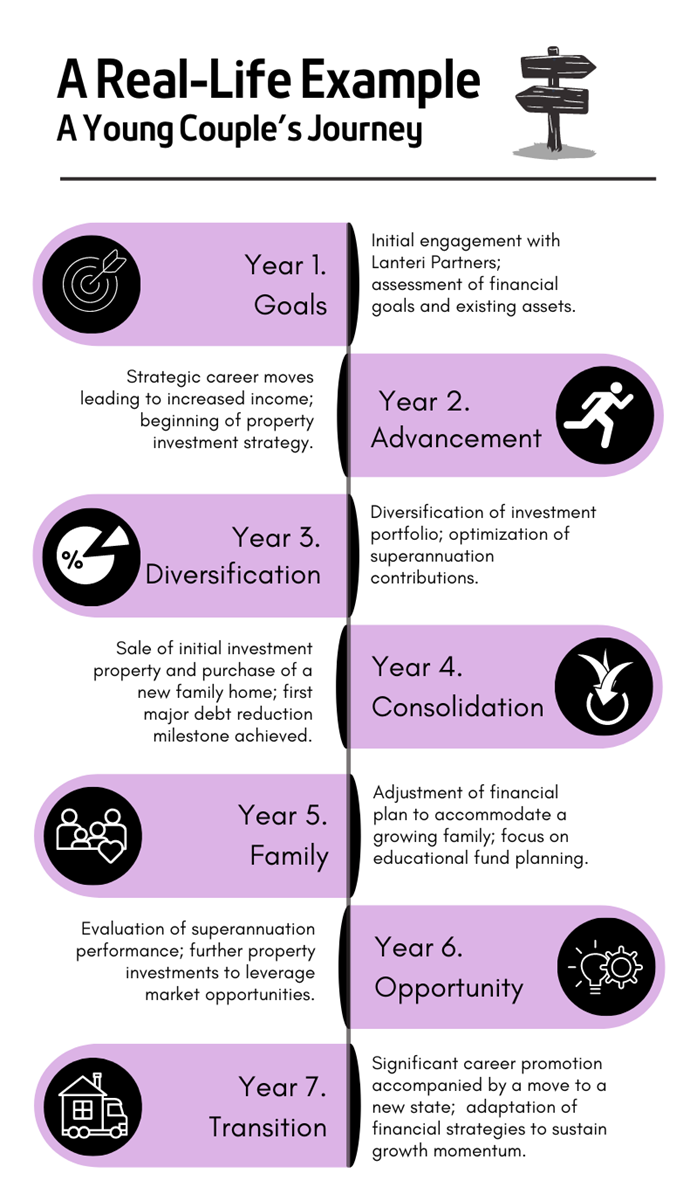

Consider the real-life journey of a young couple that engaged Financial Planning services at Lanteri Partners in their mid-30s. Initially sceptical about the value of financial advice, their perspective shifts as they engage in a tailored financial strategy.

Below is a real-life timeline based on this particular couple’s journey:

This financial journey encompasses not just investment and superannuation optimization but also navigates through employment changes, property investments, and planning for their family’s future. Their story underscores the transformative power of personalized financial advice, illustrating how it can align with evolving life stages and financial goals, leading to significant growth and security.

The role of superannuation in this transformation cannot be overstated. As a critical component of long-term financial well-being, engaging with it strategically from an early stage can dramatically alter one’s financial landscape upon retirement. Yet, its importance is often overshadowed by more immediate financial concerns, underscoring the need for comprehensive financial education and advisory services that resonate with younger clients.

Addressing the cost-value paradox is crucial. By demonstrating the tangible benefits and long-term gains of professional financial planning, advisory firms can bridge the gap between perception and reality. The key lies in demystifying financial advice, making it accessible and relevant to a generation that stands to inherit significant wealth but may be ill-prepared to manage it effectively.

The narrative that millennials and younger generations are disengaged from traditional financial planning needs revisiting. Through the lens of evolving client demographics and the compelling journey of individuals who have reaped the benefits of early and strategic financial engagement, it’s clear that the value of financial advice transcends generational divides. For those willing to look beyond the immediate costs, the rewards of professional financial planning offer not just financial growth but a roadmap to achieving life’s milestones with confidence and clarity.

Interested in transforming your financial future? Lanteri Partners Financial Planning services are tailored to guide young professionals and seasoned investors alike.

Reach out to discover how our expertise can align with your financial goals. Contact us today.

Tarik Karama

Risk, a concept that has plagued and perplexed humanity for centuries, remains a complex and multifaceted study. Nobel Prizes have been awarded to those who could provide elegant solutions to the intricate puzzle of risk. While risk management is commonly seen as the effort to address negative or harmful risks, fundamentally, it is the recognition of the potential that any unknown circumstances may materialise. In the realm of finance, the understanding of risk extends beyond downside risk to encompass upside risk, recognising that both outcomes are unknown.

In essence, risk is an intellectual attempt to grapple with the uncertainties of the future. Its complexity is directly linked to the amount of information available.

Consider the scenario of a blindfolded individual standing on the edge of a street, tasked with crossing safely. The risk of being hit by a passing car is so great that attempting to cross becomes perilous. Removing the blindfold transforms the situation from highly risky to low risk, highlighting the critical role of information in risk assessment.

In this scenario, the question arises: What element impacted risk the most—the road or the pedestrian crossing it? This analogy draws parallels with the finance world, where risk is often linked to investments or products. However, the real source of risk lies in the investor’s knowledge about the investment or industry. Just as opening the eyes of the blindfolded pedestrian drastically reduces the risk of crossing the road, an investor’s awareness and understanding significantly mitigate the risks associated with an investment.

Drawing inspiration from renowned investor Warren Buffett, we find a practical application of this concept. Buffett’s core tenet is investing in assets within his scope of competence. In other words, he only crosses roads that he is confident he can navigate safely. This approach distinguishes his investment decisions from those made by individuals with different levels of information and expertise.

This distinction emphasises that, while the investment might seem identical on the surface, the information processing and risk perception between an astute investor like Buffett and an average investor differ significantly.

At Medici Invest, we place a significant emphasis on education. Heightened education opens an individuals’ world and enhances their confidence to act. By providing a deeper understanding of investments, industries, and markets, we empower individuals to manage risk in their life more effectively. The calculations that once held them back become more manageable, allowing them to navigate the complex roads of finance with confidence.

Risk, often seen as an insurmountable challenge, becomes a navigable terrain with the right information and education. The road to financial success is paved with informed decisions, and at Medici Invest, we strive to guide individuals in crossing these roads with confidence and competence.

Medici Invest is distributed by Lanteri Partners Financial Management Pty Ltd (ACN 060 748 594, AFSL 239 127) and administered by OpenInvest Limited (ACN 614 587 183) via the OpenInvest Portfolio Service (ARSN 628 156 052). This website provides factual information about the service, and any general advice contained does not take into account your objectives, financial situation or needs. Before making any investment decision, please review the PDS and Target Market Determination available in the Medici Invest portal under Key Documents. Should you require assistance in determining whether an investment in the service is right for you, you may wish to seek personal advice from an appropriately licensed financial adviser.

Your Investment Journey Starts Here

Complete the form to dive into your personalised investment dashboard.

Browse the platform and explore exclusive portfolio offerings tailored for you.

"*" indicates required fields